Weak Signals

A weekly newsletter about the small signals that get lost in the noise

‘If you’re feeling called to explore a life outside the boundaries you've inherited … don’t let old

stories stand in your way.’

Welcome back to Weak Signals.

Before we jump in, an above the line cheat sheet on the $GME saga and a video that perfectly sums up the week.

The GameStop short selling stock saga is front and center this weekend, to say the least.

What began as a brilliant trade idea, hive-minded on Wallstreetbets, transformed into a surrealist spectacle of internet meme culture torching Wall Street to the tune of billions. There are so many layers to this story, with so many twists and turns, that if you were following in real time, it felt like you were mainlining the internet.

The story seemed to reach a boiling point Thursday morning when Robinhood cut off the retail traders from buying $GME, but with the stock still above $300 as of Friday’s close, the trade, and this story still have legs yet.

I loved it but I want to be careful with it.

This story obviously means something, but to borrow from Benedict Evans; it is a bit of a Rorschach test. This story can mean everything, and anything and nothing, all at once.

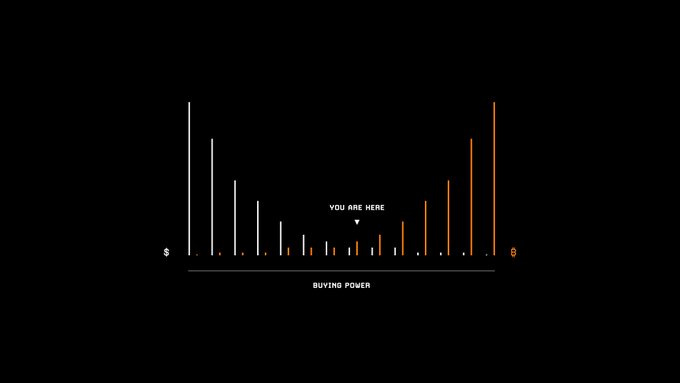

· Is this a story about the long maligned ‘dumb money’ retail investor, (who FYI, was never that dumb to begin with), empowered by open market access and aggregated buying power, trouncing the very serious investor?

· Is this the new playbook for how to hack political elections?

· Is this the Capitol Hill Riots recast online?

· Is this a story about power – who has it, how is it wielded and for whose benefit?

· Is this a dire warning that social media has the ability to catalyze mass instant global action? And how that ability could cause cataclysmic consequences if we all jump to the wrong conclusions on the wrong story at the wrong moment?

· Is this a story about the uselessness of short-selling? (Perhaps the most specious take of all.)

As I said, this story means everything, and anything and nothing, all at once.

The whole saga feels like the opening to Dickens Novel.

"It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness…..

In last week’s Weak Signals, I hypothesized a new dialectic emerging around the place of meditators who control access to society.

The internet empowers us.

Paradoxically, the internet consolidates power.

Beyond the X and O’s of the story, that was the tension being expressed this week, and it’s why people found themselves beside strange bedfellows in their shared response.

We are crossing a chasm in real-time. The role of centralized authority (and who it serves) will continue to a flash point of debate as this dialectic finds new means and modes of expression.

Last week’s it was Trump being de-platformed by Big Tech.

This week it was about Wall Street de-platforming retail investors.

Next week, it’ll be about…

I guess this is all just a really long winded way of saying Bitcoin.

As one of the largest money managers in the world and a devoted systems thinker, what Ray Dalio thinks of Bitcoin is well worth reading.

The only thing classier than Greg Norman’s Golf Swing is his house.

One of the past times I’ve picked up during COVInfinity is watching architectural videos on Youtube. I like to think of it as a high-end HGTV’esque escape. Michelen starred chef, Fina Puigdevall Catalonia home is one of my favorites. Set in the foothills of the Pyrenees, her house is other worldy.

On the off-chance next week’s Weak Signals goes out after kick-off - I’ve got Tampa Bay. Who do you have? Let me know.