“In winter we close the windows

and read Chekhov,

nearly weeping for his world.

What luxury, to be so happy

that we can grieve

over imaginary lives.”

Welcome back to Weak Signals.

Inspired by the long weekend, I attempted something a bit ambitious this week. Fair warning, I don’t know if I quite landed the rocket. So for those of you who want the Coles Notes, feel free to watch the two-minute primer below. I promise I won’t begrudge you.

But for those of you brave enough to pack a parachute … strap in, we’re headed to Mars.

I first started following Bitcoin in 2014. It was at the tail end of my prop trading days. That I didn’t buy BTC when it trading sub $1,000 tells you a lot about why it was the end, not the beginning of my prop trading days. But I digress. For old timers like me who were watching BTC then, the narrative in 2014 turned mostly around ‘libertarianism’ and the Mt. Gox bitcoin exchange fraud.

The promise of Bitcoin in 2014 (scarcity, divisibility, utility, and transferability) was the same then as it is now. The emphasis was different though. Step into any forum or tweet-thread extoling the virtues of BTC, and it read way more like a political theory lecture than an economics class.

You were far more likely to encounter commentary on autonomy, political freedom, state skepticism and resistance to government censorship than you ever were store-of-value, digital-gold, diamond hands, and have fun ‘being poor’ memes.

This was 2014. Big Time.

Then Mt. Gox hit, and it was the closest the crypto-currency came to dying.

For those that don’t know, Mt. Gox was one of earliest, and at the time, the largest bitcoin exchanges in the world. It abruptly closed down in 2014 when it was revealed its own owners were co-conspirators in a massive coordinated theft. They lost 850,000 Bitcoins. 7% of the total float. About $42.5 Billion USD of coins at today’s price.

So for me at the time, that BTC, an instrument of libertarian politics was almost brought down by a fraud committed in the absence of regulations had a certain symmetry to it.

Maybe we do need some regulation after all?

In 2014, to my mind, Bitcoin always felt a bit destined to fail. Per those forums and tweet-threads, BTC was at its core, a political ideology wrapped in a technology, counter to the mainstream. It was either too unregulated or too powerful for it’s own good, and more than anything, if it got too big, it would get banned.

So I didn’t buy it, I have fun ‘being poor’ and I stopped paying attention (mostly 😉) until last week.

There’s been a lot of ink spilled on Telsa’s announcement that the EV car manufacturer has allocated $1.5 Billion of its cash reserves to Bitcoin. Telsa, who intends to use their BTC reserve to facilitate payment for cars in the future, is inarguably one of the most forward looking, climate sensitive companies in the world. Their cryptocurrency investment, however, raises questions.

For one, how does it reconcile with Telsa’s climate and environmental aims: Bitcoin is by its structure, energy intensive. Equally, what does this allocation say about Telsa’s priorities? Their BTC investment is equivalent to their 2020 R&D budget.

That seems, off?

But while Telsa and Bitcoin are very different things, they share similar trajectories. Both have ratcheted to higher and higher valuations as their individual narratives have strengthened, Cassandra’s be damned. I don’t know where Telsa’s stock goes from here, although you could do worse than Ben Thompson’s take, ‘Mistakes & Memes. Telsa; the original meme stock. Elon Musk; the meme master’,

In the micro stock-price sense - where Telsa goes matters.

In the macro story-sense and in this stories sense - it doesn’t.

Telsa pulled forward the adoption and advancement of EV cars by tens years. Elon Musk has singularly done more for climate change than any individual on earth. History will judge him fondly, independent of his companies success or failure.

Returning to my 2014 thesis, how did Telsa’s purchase of BTC just alter it’s trajectory.

My favorite book of the past five years was undoubtedly the best seller ‘Sapiens’ by Yuval Noah Harari. In Sapiens, Harari doesn’t introduce many new ideas, but what makes the book special is how he crystalizes, connects and contextualizes so many big ideas together.

One of the most powerful ideas Sapiens introduced to me was ‘intersubjective realities.’

As Harari tells it, while both animals and humans experience 'objective reality' (e.g., trees) and 'subjective reality' (e.g., feeling pain), only humans experience 'intersubjective realities' (e.g., human rights, corporations, money).

Intersubjective fictions that take become shared fictions. There’s something very McLuhan about shared fictions; particularly their reliance on language and writing to bridge, than shape reality.

In Harari’s telling, language the original tool. And as McLuhan says, ‘First we shape our tools, and then our tools shape us.’ And when it comes to money (particularly fiat), the ultimate shared fiction, the ultimate tool, applying Harari, you truly understand the value of belief.

So how does this all relate to Bitcoin and Telsa’s Treasury investments?

Going back to Bitcoin’s foundation, decentralized currency, by definition contrasts with centralized currency. It pushes back at state authority. As Satoshi wrote in early threads, “The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

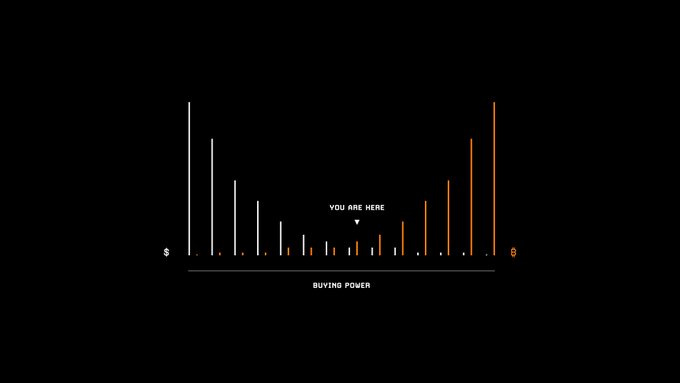

Centering this in the here and now, governments around the world were already systemically pursuing loose monetary policy pre-COVID. Now it’s just straight Modern Monetary Theory YOLO.

But to quote Bill Marshall, “Modern Monetary Theory is not a revolutionary new system or drastic threat to the current establishment; it is the current establishment. MMT merely describes the global economy today: the existing fiat currency system. Governments are not constrained in their spending by a need to raise revenue.”

So where does Bitcoin come in? As Mike Co says, if Modern Monetary Theory is the thesis, then Bitcoin is the antithesis. To MMT and those in power pushing it the world over, BTC is the theoretical nemesis. BTC takes a drastically different philosophical approach to money creation and access than MMT.

“Bitcoin could become a universal economic escape hatch to allow individuals insurance against local economic meltdown. Anyone with internet access can potentially access this alternative store of value to guard their wealth.”

But we knew that already, right?

Back in 2014, Bitcoin was destined to fail, intuitively, because it represented a threat to the system. It was a political ideology wrapped in a technology. I wouldn’t have been able that articulate then. I’m not sure how well I’m articulating it now, but it’s always been sort of understood.

So how did Telsa change the politics of Bitcoin?

Telsa has changed the calculus on Bitcoin’s narrative because it’s made it almost impossible to ban.

Telsa investment has removed the largest existential threat to Bitcoin.

Telsa has reshaped the reality of Bitcoin.

Telsa’s has pushed Bitcoin from intersubjective reality to shared fiction.

Today, MMT is expressed in policy through asset buying, debt monetization and quantitative easing. MMT’s loose money STAB drives asset price inflation (which does a lot of things but for the sake of simplicity makes stocks go up). Stocks going up spur confidence as individuals feel positive about the direction of the economy. Companies balance sheets are improved and they are inspired to invest, hire and spend as well.

But what instead of taking newly found capital to invest and spend, people, but more importantly companies, invest in Bitcoin instead?

The action takes money out of the fiat system. | Fine but nothing new

It validates Bitcoin as a store-of-value which inspires confidence in it from investors for another. | This helps but it isn’t everything

If Bitcoin sits on the balance sheet of fortune 500 companies, then banning Bitcoin would cause stock markets to fall, defeating the whole idea of MMT theory to begin with. Which sort of makes it hard to ban. | Ohh this is new

Telsa’s purchase of BTC is a Trojan Horse for the crypto-currency into fiat. What Telsa disclosed in it’s 10-k is that it had updated it’s investment policy to provide them with more flexibility to further diversify and maximize returns on our cash.

A modest way of describing reality.

As the rest of the S&P 500 follows, reality reshapes.

Telsa pulled forward the adoption and advancement of EV cars by tens years.

Elon Musk singularly done more for climate change than any individual on earth.

What he just did with Bitcoin matters more.

🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀

Diamond hands, you just hit escape velocity.